Outside of a company’s senior executives, the product line owner is probably the one person whose performance is most highly correlated with the overall success of a company. Distinct from the product development manager, who primarily works with engineers building a product, the product line owner is the CEO of her product line and an expert in the market. She intimately knows the strategy of every single one of her competitors and is constantly challenging and re-evaluating her assumptions and strategy. With such a high impact role, it’s important to have a solid framework upon which to base product strategy decisions. The following post is a basic framework for the job of product line owner in a technology company. The lesson here is derived from lectures and notes passed to me by Dr. Dwight Porter Ph.D of Applied Decision Resources. Anyone who has been lucky enough to work with Dwight will tell you that he is a rare and talented advisor. He has taught me what it means to be a product manager and has completely transformed many companies that are now household names.

Step 1) Define your customer

No matter what you do, always start with the customer in mind. Who are you targeting with your product? What does the customer look like who’s going to give you money in exchange for your product? Customer definitions need to be specific and concrete. Vague customer definitions will set your sales teams up for failure as they won’t know who to target. If your product has multiple uses or applications, create multiple customer segments. Don’t worry about comprehensively defining all of the customers who make up the entire market, just define the customers that you will be targeting. For a nascent product, any more than three to four customer segments is too many.

Step 2) Define the size of your opportunity in potential sales

Based on the definition of your customer segments, you should be able to make an educated guess about the size of the opportunity in each segment. What is the total amount of money that each of your customer segments has to spend on your product? If you don’t like what this number looks like, go back to step one and start over.

Step 3) Define your value drivers

Put yourself in the mindset of each of your customers segments and then ask yourself “what creates value for me?” Shoot for between four and twelve categories of value that can be created for the customer. These should heavily overlap with the customer’s selection criteria (although customers are notoriously bad at asking for what they really need).

Example Value Drivers (for a car company):

- 0-60 speed

- Gas mileage

- Technology in the car

- Warranty and service

- Brand and reputation of the car

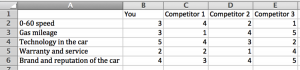

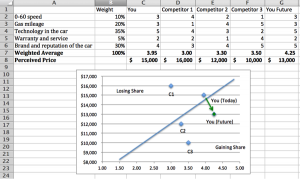

You should also create an analytic framework on top of your value drivers. For each value driver, give your product a rating of 1-5 (one being the lowest, five being the highest) and do the same thing for each of your competitors. This should leave you with a chart that looks like this (note – you should do this exercise separately for each of your customer segments; if the chart for any two of your customer segments looks too similar, consider redefining your customer definitions to combine the two segments):

Step 4) Price/Value Map

Building on the work you did in step three, again put yourself in the shoes of your customer and create a “price/value map”. There are three easy sub-steps to building your price/value map.

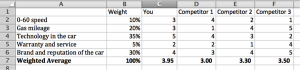

Sub-step a) Weight your value drivers.

Not all value drivers are equally important to your customers. Weight each of the value drivers based on how important they are to your customers and develop a “weighted average score” for the perceived value that you and each of your competitors provide.

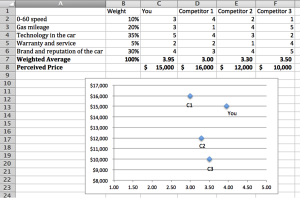

Sub-step b) Draw the map.

Layer in perceived price and map both variables to a price/value chart.

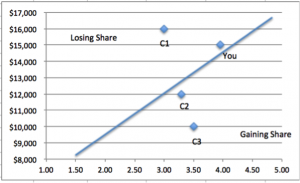

Sub-step c) Draw the “gaining share” / “Losing share” line.

Draw a line over your price value map to indicate which players are gaining and losing share. The steepness of the line indicates price elasticity in the market. A very steep line indicates that your customers are not very price sensitive, a shallower sloping line indicates that price is a major variable in the market. Important to note: this chart is about market share not about absolute new business wins. It’s totally possible for all players in the market to be winning new business (in a fast growing market) but what’s important is how fast you are winning business relative to the growth of the market. If you are growing 10% year over year, but the market is growing 20% year over year, you are losing share.

In the example I’ve outlined, you have the best product, but you are losing share because your price is about $500 too high.

Step 4) Create your product strategy

Which value drivers are you going to improve to better appeal to your customer segments? What price are you going to charge for your service? Use your price/value map to chart your strategy, plan your targeted product improvements and your pricing strategy.

By increasing your Brand and Reputation from 4 to 5 and dropping your price from $15,000 to $13,000 you go from being a share loser to a strong share gainer at the upper end of the market.

Step 5) Create your marketing strategy

Based on your product strategy, what do you want your customers to think about your products? If you want your customers to think you have the best technology, you should create a marketing strategy to support that point. If you want your customers to think you have the lowest price, your marketing plan should reflect that. The goal of your marketing plan is control perception in the market and seed knowledge of your key value drivers. When your sales people meet a customer for the first time, the customer should already know about your top one or two value drivers.

Step 6) Learn and Iterate

Steve Blank once said “No business plan survives first contact with customers”. Once you have created your plan, be prepared to change it immediately. Get out of the building, talk to customers, sell what you can, and learn. Gear up for lots of rejection. When customers say no, it’s not a bad thing, but you need to figure out why they’re saying no and adjust your strategy. Is your price too high? Was there an important value driver that you didn’t include in your model? Were you weaker vs. your competition than you had originally thought? Learn, learn, learn and iterate. Then go back out into the field and learn some more. Keep updating your model along the way. For sales that you are not personally involved in, institute a thorough “win/loss” analysis for any piece of new business pitched (regardless of whether it was won or lost). A good product line owner will always conduct win/loss analysis herself to ensure all learnings are accurately captured.

A common error is to create your strategy, communicate to the team, and then shift into execution mode. This is deadly in a product organization. Don’t get me wrong – you must provide solid, unchanging direction to your field and engineering teams, but you also need to constantly be challenging and revising your plan. For more on this challenge, see my post from two weeks ago about the challenge of being three different people.